Last updated on February 5th, 2024

An income statement, also known as a profit and loss statement, is one of the essential financial reports that businesses use to measure their performance. It provides a comprehensive overview of a company’s financial activities, showcasing not only the revenue generated but also the expenses incurred over a specific period, typically a quarter or a year. By analyzing the income statement, stakeholders can gain insights into the company’s profitability, cost structure, and overall financial health.

Traditionally, preparing an income statement manually was a laborious and time-consuming task, often prone to errors. However, with the advent of advanced technology and online calculators, the process has become much more manageable and efficient. These tools automate the calculations, reducing the risk of human error and streamlining the entire process. Now, businesses can generate accurate and detailed income statements with ease, saving valuable time and resources that can be allocated to other critical aspects of their operations.

By leveraging online calculators and other software solutions, companies can not only improve the accuracy and efficiency of their financial reporting but also gain a deeper understanding of their financial performance. With more detailed and comprehensive income statements, businesses can identify trends, evaluate the effectiveness of their strategies, and make informed decisions to drive future growth and success. The availability of these technological advancements has undoubtedly revolutionized the way businesses analyze and present their financial data, empowering them to make data-driven decisions and thrive in today’s dynamic and competitive business landscape.

Are you looking to build an online calculator for your Income Statement? iTechnolabs, a leading software development company, is here to assist. Our team of experienced developers can create a user-friendly online calculator tailored to your company’s needs.

Table of Contents

ToggleWhat is an Income Statement?

An income statement, also known as a profit and loss statement, is a financial document that summarizes a company’s revenues, expenses, and net income or loss over a specific period. This statement gives stakeholders an overview of how well a company has performed financially. It lays out the different sources of income and types of expenses, breaking them down into detailed categories. The bottom line of an income statement indicates whether the company made a profit (if revenues exceed expenses) or incurred a loss (if expenses exceed revenues) during the period in question. Understanding how to write an income statement is essential for tracking a company’s financial trajectory and making strategic decisions.

Before we dive into preparing an income statement using an online calculator, it’s essential to understand what an income statement is and why it’s crucial for businesses. An income statement, also known as a profit and loss statement, shows a company’s financial performance by comparing its revenues with expenses over a specific period. It helps businesses track their profitability, identify areas of improvement, and make informed financial decisions.

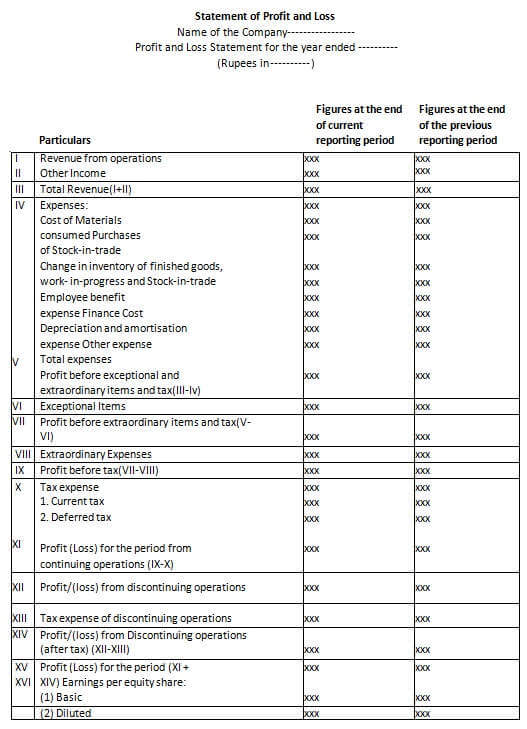

Income Statement Format

The format for preparing an Income Statement is as follows:

Benefits of Using an Online Calculator to Prepare Income Statement

There are several benefits to using an online calculator for preparing income statements:

- Accuracy: Income statement calculations can be complex and prone to human error when done manually. Online calculators eliminate this risk by providing accurate results every time.

- Time-saving: Preparing an income statement using an online calculator is much faster than doing it manually. With just a few clicks, businesses can get their financial report ready in no time.

- User-friendly: Many online calculators are user-friendly and require minimal knowledge of accounting principles. This makes them accessible to business owners with little or no accounting background.

Steps to Prepare an Income Statement Using Online Calculator

Follow these simple steps to prepare an income statement using an online calculator:

- Gather all necessary financial information, including revenue and expense figures, for the specified period.

- Choose a reliable online calculator that suits your business needs.

- Input the gathered financial data into the appropriate fields in the online calculator.

- The online calculator will automatically calculate the net income, which is the difference between total revenues and expenses.

- Review the income statement generated by the online calculator for accuracy.

- Make any necessary adjustments or corrections to ensure the information presented is correct.

- Save a copy of the income statement for future reference or share it with stakeholders as needed.

Comparison Between Balance Sheet vs Income Statement

- Nature: The Balance Sheet is a ‘snapshot’ of a company’s financial status at a specific point in time. It provides a comprehensive overview of a company’s assets, liabilities, and shareholders’ equity, giving stakeholders a deeper understanding of its financial health. On the other hand, the Income Statement is like a ‘movie’ that showcases the financial performance over a particular period, revealing the company’s revenues, expenses, and profits or losses in a dynamic way.

- Contents: The Balance Sheet delves into the details of a company’s assets, including both tangible and intangible assets, its liabilities, such as debts and obligations, and the shareholders’ equity, reflecting the company’s net worth. In contrast, the Income Statement outlines a company’s revenues, encompassing sales, fees, and other income sources, its expenses, including costs of goods sold, operating expenses, and taxes, and ultimately calculates the profits or losses generated during the specified period.

- Purpose: The Balance Sheet serves as a valuable tool for assessing the company’s net worth, providing insights into what it owns and what it owes. This aids in evaluating the company’s liquidity, solvency, and financial structure, helping stakeholders make informed decisions. On the other hand, the Income Statement aids in understanding the company’s profitability, highlighting the difference between its revenues and expenses. It assists in evaluating the company’s financial performance, forecasting future performance, and comparing its financial health with peers in the industry.

- Frequency of Preparation: Generally, Balance Sheets are prepared annually to capture the financial position of a company as of a specific date. However, depending on the business requirements and regulatory obligations, companies may also prepare interim Balance Sheets quarterly or biannually. On the other hand, Income Statements are usually prepared on a more frequent basis, either quarterly or annually, to provide a comprehensive view of the company’s financial performance over a specific period.

- Usage: The Balance Sheet is a valuable tool in conducting liquidity analysis, allowing stakeholders to assess the company’s ability to meet short-term obligations and manage cash flow. It also aids in solvency analysis, enabling stakeholders to evaluate the company’s ability to meet long-term obligations and sustain operations. Additionally, the Balance Sheet plays a crucial role in financial structuring, providing insights into the company’s capital structure and its ability to raise funds. On the other hand, the Income Statement is useful in performance evaluation, allowing stakeholders to assess the company’s revenue generation, cost management, and overall profitability. It also assists in forecasting future performance, providing insights into potential trends and helping with strategic planning. Furthermore, the Income Statement facilitates comparison with peers in the industry, enabling stakeholders to benchmark the company’s financial performance against similar companies and identify areas for improvement.

How to Prepare an Income Statement Using Online Calculator?

- Determine the period: Begin by selecting the specific period for which you want to prepare the income statement. This could be on a quarterly or annual basis, depending on your preference and reporting requirements.

- Gather financial data: It is crucial to ensure that you have accurate and up-to-date information on the company’s revenues and expenses for the selected period. This may include sales figures, cost of goods sold, operating expenses, and any other relevant financial data.

- Choose an online calculator: To make the process quick and efficient, consider using one of the many free online calculators available. These tools are designed to assist you in preparing an income statement by guiding you through the necessary calculations.

- Enter data: Once you have selected your preferred online calculator, input the financial data into the relevant fields. This may include entering the revenue, cost of goods sold, operating expenses, and any other applicable information.

- Review the results: After entering all the required data, take a moment to review the results generated by the online calculator. This step is essential to ensure the accuracy of the income statement and identify any potential errors or discrepancies.

- Analyze the income statement: With the calculated figures in hand, it is time to analyze the company’s profitability. Use the income statement to evaluate the financial performance and identify key insights that can inform future financial planning and decision-making.

- Save and share: Many online calculators offer the option to save and share the generated income statement. This feature allows for convenient record-keeping and also enables you to share the statement with other stakeholders, such as colleagues or investors.

- Make necessary adjustments: If there are any discrepancies or changes in the financial data, simply update the figures in the online calculator and generate a new income statement. This flexibility ensures that you can always maintain an accurate and up-to-date view of the company’s financial performance.

Income Statement Using Online Calculator for Business Analysis

An Income Statement Using Online Calculator is an invaluable tool for business analysis, providing a comprehensive snapshot of a company’s financial performance. By utilizing user-friendly and efficient online calculators to prepare the income statement, businesses can effortlessly track their revenue and expenses over time, gaining deeper insights into their financial health. This not only enables them to identify areas for improvement but also empowers them to make informed decisions based on accurate and reliable financial data.

Furthermore, the precise calculations provided by online calculators offer businesses the opportunity to uncover potential profit opportunities, make strategic investments, and effectively budget for future growth. With a clear understanding of their financial standing, businesses can confidently allocate resources and capitalize on prospects for expansion.

Moreover, the use of online calculators for income statement preparation eliminates the risk of human error and significantly saves valuable time that would otherwise be spent on manual calculations. This time-saving advantage allows business owners to focus their energy and attention on other crucial aspects of their operations, such as customer satisfaction, product development, and market expansion.

In summary, leveraging online calculators for income statement preparation not only enhances accuracy and efficiency but also empowers businesses to make data-driven decisions, seize growth opportunities, and prioritize strategic initiatives. By streamlining financial analysis and freeing up valuable time, businesses can optimize their operations and drive long-term success.

How to Much Does it Cost to Make an Online Calculator For Income Statement?

Developing an online calculator for income statements presents an indispensable tool for both businesses and individuals to streamline their financial planning and analysis. On the subject of cost, developing such a calculator can vary significantly depending on complexity, features, and customization. Generally, the cost to develop a basic model starts from around $5,000, but this can rise to $20,000 or more for a highly sophisticated system with advanced functionalities such as real-time data processing, integration with other financial software, and multi-platform compatibility. It is essential to factor in these cost to make considerations during the planning phase to ensure budget alignment. For maintenance and updates, a retention budget of 10-20% of the initial cost to create is recommended annually. Thus, businesses considering the cost to build an online calculator should anticipate a comprehensive gauge, which includes initial development, deployment, and continuous improvement to keep the tool relevant and efficient.

The cost to develop an online calculator for income statements can vary widely depending on a range of factors. To estimate the cost to make such a tool, one must consider the complexity of the calculator, the level of customization required, and the chosen technological platform. Typically, the cost to create a basic online calculator starts from a few thousand dollars for a simple, template-based solution. However, for more advanced features like integration with accounting software or real-time data analysis, the cost to build can escalate to tens of thousands of dollars, as it requires a more sophisticated design and possibly a team of experienced developers and financial experts. To ensure accuracy and user-friendliness, investing in quality development is crucial for such financial tools.

Why Choose iTechnolabs to Create an Online Calculator For Income Statement?

- Expertise: iTechnolabs has a team of professional accountants and software developers who are skilled in creating sophisticated financial tools like our Online Income Statement Calculator.

- Time and Cost Efficient: Our calculator is designed to save businesses valuable time and resources that would otherwise be spent on manual data entry and calculation.

- Accuracy: Our tool ensures all transactions are recorded and classified correctly, reducing the risk of manual errors.

- Adherence to Standards: The calculator is designed to be in line with accounting standards and tax laws, ensuring your Income Statements comply with all necessary regulations.

- User-Friendly Interface: The interface of our calculator is intuitive and easy to navigate, even for those who are not proficient in accounting.

- Tailored to Your Needs: Our services can be customized to meet the unique needs and requirements of your business.

- 24/7 Customer Support: We offer round-the-clock customer support to assist you with any issues or queries regarding the use of our online calculator.

With iTechnolabs, creating an Income Statement using an online calculator is fast, accurate, and hassle-free. Our team of experts will guide you through the process and provide ongoing support to ensure your financial statements are always up-to-date and accurate. So why wait? Contact us today and let us help you take your business to new heights with our Online Income Statement Calculator

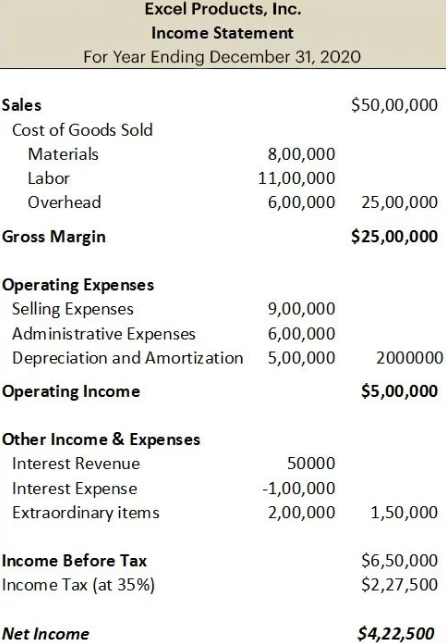

Income Statement Example

The below example will give you a better understanding of what’s reported on an income statement, its format, and how you should lay the data:

Discuss some common mistakes while generating Income Statements

Here are some common mistakes to avoid while generating Income Statements:

- Incorrect classification of expenses: Misclassification of operational costs as capital costs or vice versa can significantly distort the financial picture of the company. It’s crucial to understand the difference and classify expenses correctly.

- Inaccurate recording of transactions: This is a common error where transactions are either not recorded accurately or not recorded at all. It’s essential to maintain a meticulous record of every transaction for an accurate representation of the company’s financial health.

- Inconsistent accounting practices: The accounting practice should be consistent throughout the company. Changing accounting practices midway can lead to discrepancies in the financial statements.

- Overlooking revenues or expenses: This is a common error where certain revenues or expenses are overlooked while preparing the Income Statement. This can lead to an inaccurate depiction of the company’s profits or losses.

- Incorrect interpretation of accounting standards or tax laws: Misunderstanding or incorrect application of accounting standards or tax laws can lead to significant discrepancies in financial statements.

Remember, an Income Statement Using Online Calculator can help streamline and automate this process, but a thorough understanding of financial accounting is required to ensure the accuracy of the data entered into the calculator.

Do You Want to Build an Online Calculator for Income Statement?

Are you looking to build an online calculator for your Income Statement? iTechnolabs, a leading software development company, is here to assist. Our team of experienced developers can create a user-friendly online calculator tailored to your company’s needs. This tool will automate the process of generating Income Statements, reducing manual errors and saving valuable time.

It enhances the accuracy of data entry, ensuring all transactions are recorded and classified correctly. With our Income Statement Online Calculator, you can maintain consistent accounting practices and accurately interpret accounting standards and tax laws. Reach out to iTechnolabs today to simplify your financial accounting with our custom-built online calculator.